Closeup overhead view of a young couple sitting on the living room floor and looking at decoration brochures and choosing how to improve their new apartment.With all that is going on in the world, a global pandemic, supply chain issues, highest inflation in 40 years, the economic effects of a war in Ukraine, it can be overwhelming to think about when the right time is to buy a home.

With all that is going on in the world, a global pandemic, supply chain issues, highest inflation in 40 years, the economic effects of a war in Ukraine, it can be overwhelming to think about when the right time is to buy a home.

On a local level, there is a pent-up demand for homes that have been building for years. Builders haven’t kept up with demand for new housing for almost 15 years. Low inventory, especially in the past three years, have driven up prices nationally in 2021 by 20% and even though, the rapid appreciation seems to be moderating, in June, NAR reported that the median price home was up 13.4% from one year ago.

Then, of course, there are mortgage rates that have gone up by 2% since the beginning of 2022. Appreciation and rising interest rates are a double whammy for people looking for their first home or to move up. It is completely understandable that many people are faced with so much that they are sitting on the sidelines waiting to see if things will improve.

Let’s look at a hypothetical situation where buyers have the money for a 10% down payment on a $400,000 home but have decided to wait for three years to see if things improve. They need to park their money somewhere safe so that it will be available when they feel comfortable to buy but also earn as much as they can to ward off the effects of historically high inflation.

If they were to put the $40,000 into a certificate of deposit for three years that pays 2%, they would earn $2,448 in interest. With current inflation at 8.5%, the purchasing power of their down payment would diminish.

A slightly riskier alternative would be to invest it in the stock market or a mutual fund. Assuming they picked the right stock or fund that earned 7%, their $40,000 would grow to $49,002 in the same three-year period.

The problem is that homes are appreciating much faster and the buyers would either pay more to get the same home or to pay the same price in three years, the home would not have the same amenities.

If the buyer purchased the home today that appreciates an average of 5% per year, the equity in the home in three years would be $118,000 based on two dynamics: appreciation and amortization. The wealth position at the end of the three years in the home is almost three times what it would be with the certificate of deposit and over twice as much as the stock investment.

Homes have appreciated more than inflation over the last fifty years. The average home price appreciation from 1970 to 2020 was 7.16% compared to the average inflation for the same period which was 4.3%. In 2021, home prices were up close to 21% nationally compared to 7% inflation.

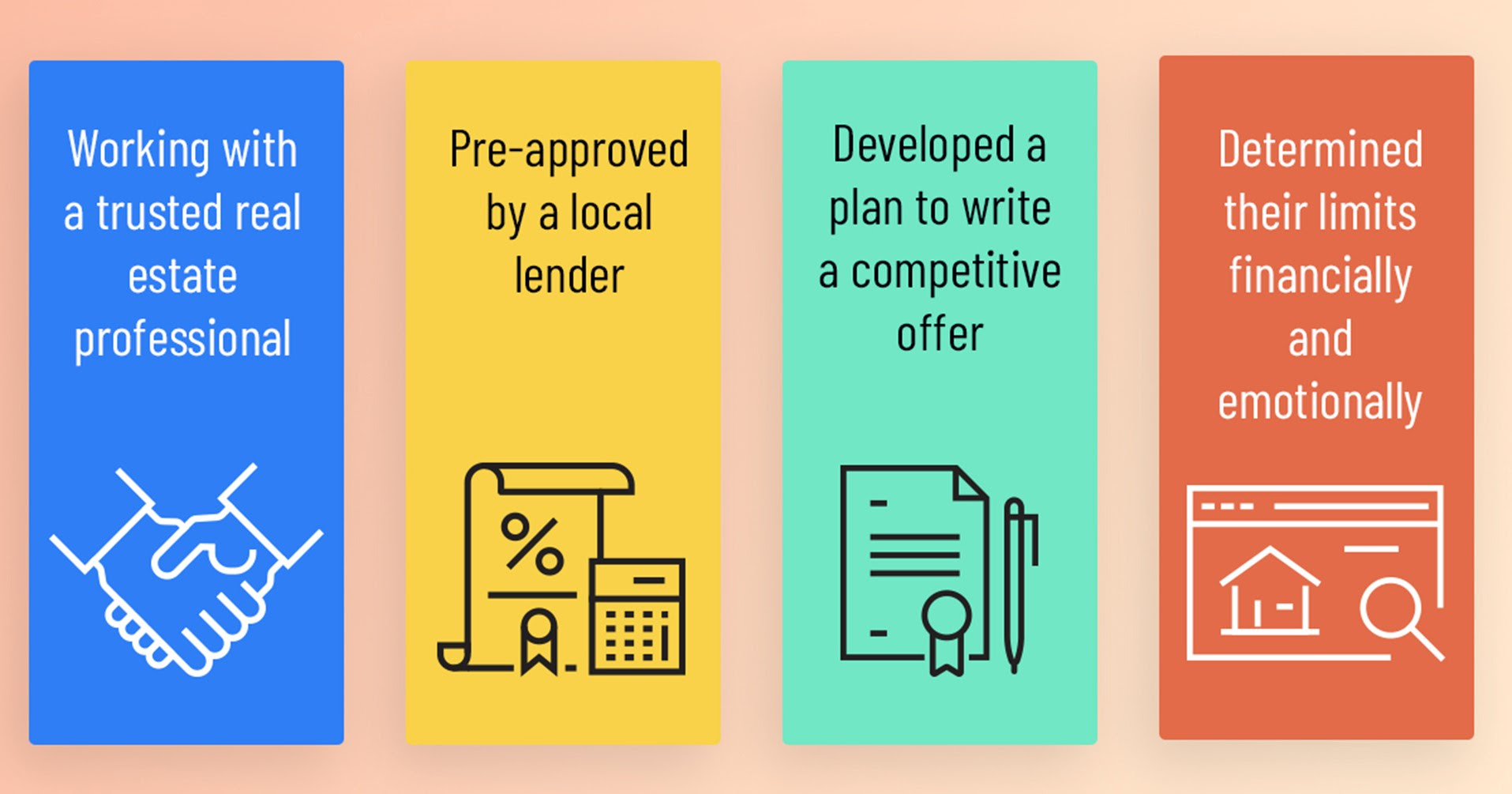

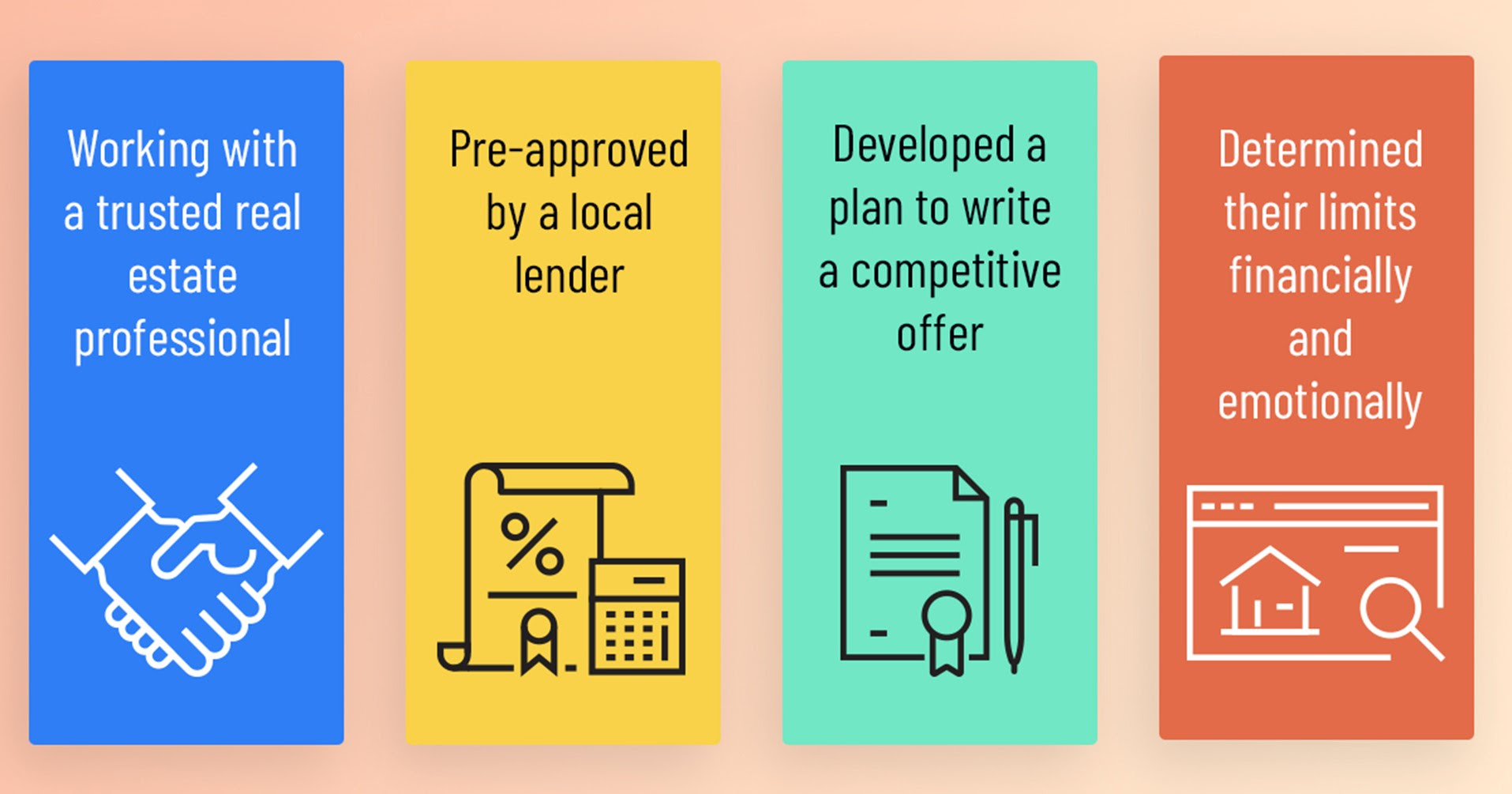

Connect with your real estate professional to find out the facts about the market, the various mortgages available, what you can expect to buy, and if you have a home, what it will sell for. Good information can make a difference in making a good decision. Download our Buyers Guide.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link